NEWS FOR WAIKIKI SHORE OWNERS – MARCH

The Open Forum Board of Director nominees, Bob Warren, Carol Laechelt and Jon Gilbert, are extremely gratified by the strong response they have received from Waikiki Shore owners and by the number of proxies they have already received. As a result, we will have sufficient owner representation to ensure a quorum is present for the March AOAO Annual Meeting. Many owners, who have been contacted, have expressed their appreciation for the chance to finally have a say in who represents them on the Board. We want to thank them for their outpouring of support and ask owners who might be undecided to join us in building a better and stronger future for Waikiki Shore.

Recently, Hawaiian Properties, Ltd. sent to owners the legally mandated AOAO Annual Meeting notice including a Hawaiian Properties, Ltd. proxy, Board nominee statements and related meeting materials. Owners should not complete Hawaiian Properties, Ltd. proxy if they truly want a change in the Board’s membership. There are simply no quorum concerns. If you have not yet signed a proxy for the Open Forum Board nominees, Bob Warren, Carol Laechelt and Jon Gilbert, or if you would like to change your proxy to support our nominees, please contact us at wsoa.hawaii@gmail.com or call us at 808.927.0506. You may also click on the link at the end of this newsletter for a new proxy form and return it as indicated.

Regrettably, we understand that a number of owners are being unduly pressured by the board president to sign his proxy. We are surprised and troubled that our board president, who is not up for re-election until 2019, would feel so threatened by having a board with three new members who have not been hand-picked by him and would bring with them a valuable set of career skills.

Owners are encouraged to resist any improper pressure and recognize that this is just another reason why we need new board members to help bring objectivity, transparency and independent thinking to our board. Please keep in mind that the vote you cast is by secret ballot.

Rich Anderson, Unit PH-9

FOLLOW THE MONEY!

Terry Jones, Unit 215

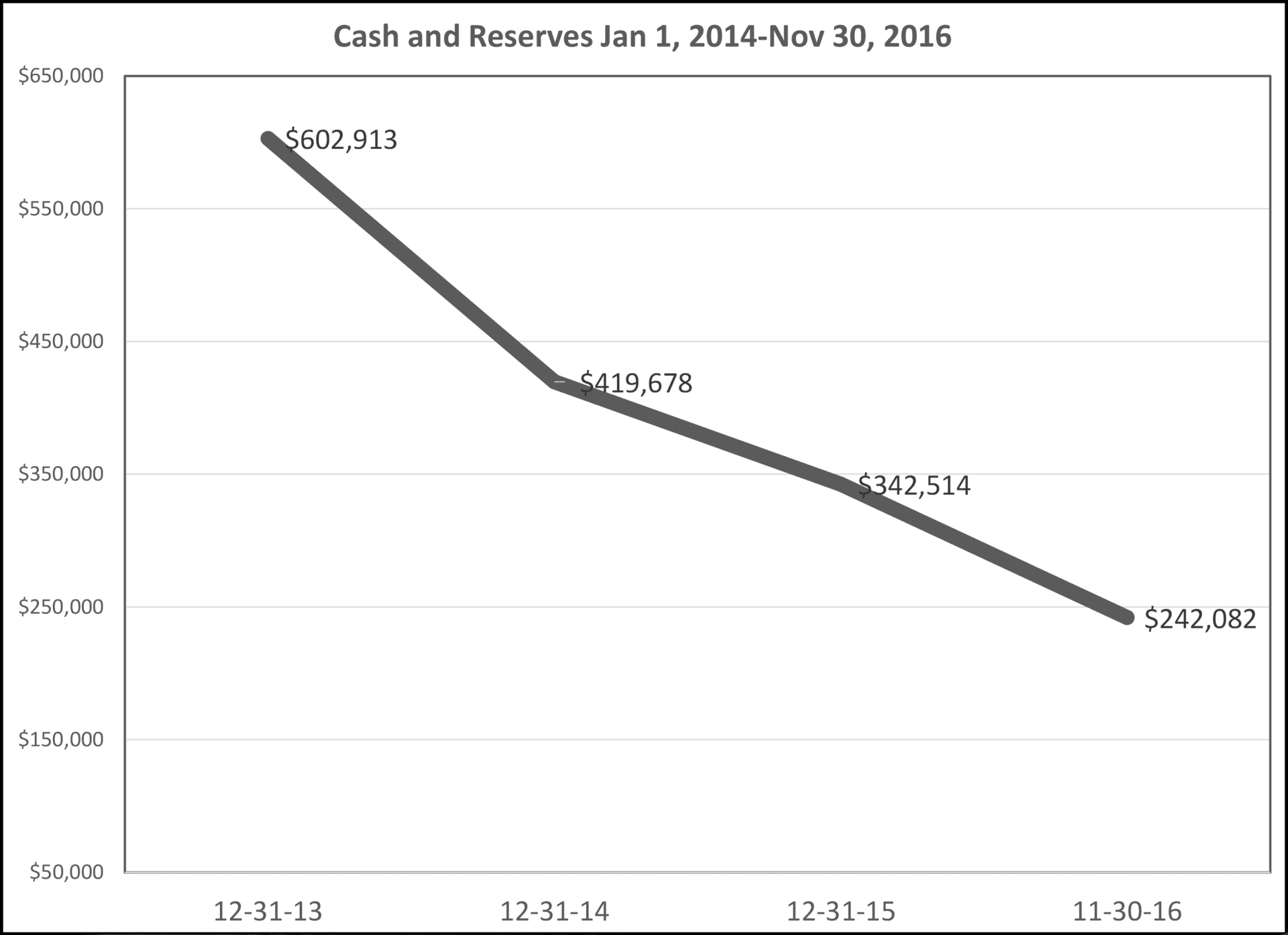

THERE IS NO DISPUTE AS TO THE AMOUNT OF CASH AND RESERVES shown on Waikiki Shore’s various financial statements for 2014 to November 2016. The question is whether our current financial condition will lead to deferred maintenance for lack of funds and leave us unprepared for emergencies or whether Waikiki Shore owners will demonstrate the ability to accurately project income and expenses.

In the January Open Forum Special Edition, Terry Block authored an article on the current financial condition of the AOAO’s cash and reserve accounts. Terry Block reported that the cash and reserve accounts stood at $242,082 as of the end of November 2016 and he did so by drawing upon the AOAO’s own financial statements.

The AOAO responded with a one page sheet entitled, "Cash and Reserve’s Breakdown 2014-2016", which reported a “net gain” of $458,000 in cash and reserves. Waikiki Shore’s financial statements clearly show that cash has not increased by $458,000. This amount must represent various deposits into the cash accounts from various sources.

Unfortunately, these deposits were less than the amounts spent for the first floor upgrades and the elevator renovations. Obviously, there was not a “net gain” of cash and/or cash reserves from 2014 to November 2016 and the AOAO was disingenuous to suggest otherwise. We are faced with the reality that the cash and reserves balance has been steadily declining:

12/31/2013 $602,913

12/31/2014 $419,678

12/31/2015 $342,514

11/30/2016 $242,082

Owners and directors alike should be asking questions about Waikiki Shore's finances and be encouraged to do so. Why? For one thing there are already very few lenders willing to make loans on our “condotels” at Waikiki Shore. The financial strength of the AOAO is considered as part of lender underwriting requirements including the amount of reserves. Anyone who wants to sell or refinance their property will become subject to scrutiny for reserves.

Another important reason is that the law requires the association to assess unit owners to fund reserves required for replacement. Yes, assessments are required by law. It is time to find out exactly where we stand on needed reserves by an accurate evaluation. The longer we close our eyes to this reality, the higher the risk of an assessment. Further, borrowing money on a line of credit is not the same as funding reserves.

The statutes governing condominiums in Hawaii can be found at www.cca.hawaii.gov/hawaii-revised-statutes. Scroll down to HRS Chapter 514A and 514B. HRS Chapter 514B-21 provides that Part VI of Chapter 514B applies to all associations like ours whether they were formed before or after 2006. Part VI includes Section 514B-148 which governs “Association fiscal matters; budgets and reserves”. A budget must include:

(1) the estimated revenues and operating expenses

(2) whether the budget is prepared on cash or accrual basis

(3) the total replacement reserves as of the date of budget

(4) the estimated replacement reserves to maintain the property

(5) a general explanation of how the replacement reserves were calculated

(6) the amount the association must collect for the fiscal year to fund the estimated replacement reserves; and

(7) information as to whether the amount the association must collect for the fiscal year to fund estimated replacement reserves was calculated using a per cent funded or cash flow plan

Simply put, numbers don’t lie. The figures in Terry Block’s article were provided by the AOAO. Its 2014, 2015, and the 11-2016 financial statements are linked to this newsletter (found in Financial Documents in this website) and the cash and cash reserve totals he reported in his article are highlighted in yellow along with relevant annotations in red. We as owners need accurate and honest financial information from the AOAO and not spurious spin. Childishly attacking the messenger by calling him an ”outrageous” fabricator ill-serves Waikiki Shore owners and does nothing to advance the discussion of our shrinking cash and cash reserves.

Terry Jones, Unit 215

THERE IS NO DISPUTE AS TO THE AMOUNT OF CASH AND RESERVES shown on Waikiki Shore’s various financial statements for 2014 to November 2016. The question is whether our current financial condition will lead to deferred maintenance for lack of funds and leave us unprepared for emergencies or whether Waikiki Shore owners will demonstrate the ability to accurately project income and expenses.

In the January Open Forum Special Edition, Terry Block authored an article on the current financial condition of the AOAO’s cash and reserve accounts. Terry Block reported that the cash and reserve accounts stood at $242,082 as of the end of November 2016 and he did so by drawing upon the AOAO’s own financial statements.

The AOAO responded with a one page sheet entitled, "Cash and Reserve’s Breakdown 2014-2016", which reported a “net gain” of $458,000 in cash and reserves. Waikiki Shore’s financial statements clearly show that cash has not increased by $458,000. This amount must represent various deposits into the cash accounts from various sources.

Unfortunately, these deposits were less than the amounts spent for the first floor upgrades and the elevator renovations. Obviously, there was not a “net gain” of cash and/or cash reserves from 2014 to November 2016 and the AOAO was disingenuous to suggest otherwise. We are faced with the reality that the cash and reserves balance has been steadily declining:

12/31/2013 $602,913

12/31/2014 $419,678

12/31/2015 $342,514

11/30/2016 $242,082

Owners and directors alike should be asking questions about Waikiki Shore's finances and be encouraged to do so. Why? For one thing there are already very few lenders willing to make loans on our “condotels” at Waikiki Shore. The financial strength of the AOAO is considered as part of lender underwriting requirements including the amount of reserves. Anyone who wants to sell or refinance their property will become subject to scrutiny for reserves.

Another important reason is that the law requires the association to assess unit owners to fund reserves required for replacement. Yes, assessments are required by law. It is time to find out exactly where we stand on needed reserves by an accurate evaluation. The longer we close our eyes to this reality, the higher the risk of an assessment. Further, borrowing money on a line of credit is not the same as funding reserves.

The statutes governing condominiums in Hawaii can be found at www.cca.hawaii.gov/hawaii-revised-statutes. Scroll down to HRS Chapter 514A and 514B. HRS Chapter 514B-21 provides that Part VI of Chapter 514B applies to all associations like ours whether they were formed before or after 2006. Part VI includes Section 514B-148 which governs “Association fiscal matters; budgets and reserves”. A budget must include:

(1) the estimated revenues and operating expenses

(2) whether the budget is prepared on cash or accrual basis

(3) the total replacement reserves as of the date of budget

(4) the estimated replacement reserves to maintain the property

(5) a general explanation of how the replacement reserves were calculated

(6) the amount the association must collect for the fiscal year to fund the estimated replacement reserves; and

(7) information as to whether the amount the association must collect for the fiscal year to fund estimated replacement reserves was calculated using a per cent funded or cash flow plan

Simply put, numbers don’t lie. The figures in Terry Block’s article were provided by the AOAO. Its 2014, 2015, and the 11-2016 financial statements are linked to this newsletter (found in Financial Documents in this website) and the cash and cash reserve totals he reported in his article are highlighted in yellow along with relevant annotations in red. We as owners need accurate and honest financial information from the AOAO and not spurious spin. Childishly attacking the messenger by calling him an ”outrageous” fabricator ill-serves Waikiki Shore owners and does nothing to advance the discussion of our shrinking cash and cash reserves.